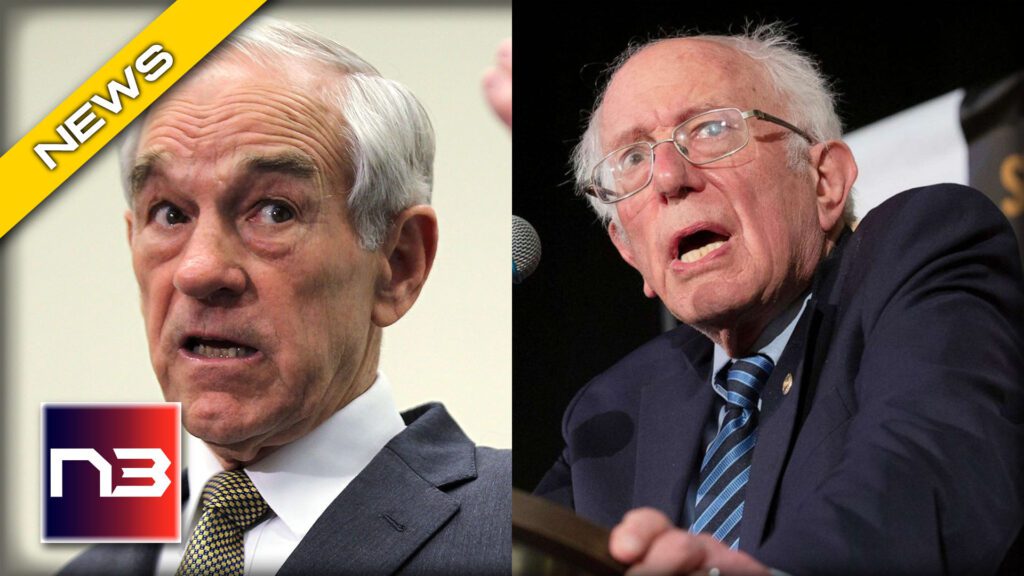

You’re probably wondering what Bernie Sanders has to do with Ron Paul. Well, it turns out they both think the Federal Reserve is doing more harm than good. In this video, I’m going to break down why Sanders thinks that and how it could impact your life.

Fight fake news with the truth everyday. Arm yourself, tap subscribe, enable notifications and fight back with Next News Network.

It is a well-known fact that Ron Paul has been a vocal critic of the Federal Reserve for many years. Now Bernie Sanders is echoing Ron Paul’s sentiments, stating that the Federal Reserve is hurting the economy. This just goes to show that Ron Paul was right all along!

Daily wire reports. Independent Vermont Sen. Bernie Sanders said the Federal Reserve is not helping Americans deal with crushing inflation.

Appearing on NBC’s “Meet the Press” Sunday, Sanders claimed that the Fed’s policy of raising interest rates, thereby slowing down the economy to lower inflation, is actually making difficult times worse for working families.

Watch

Ron Paul and Bernie sanders are on the same side when it comes to blaming the Federal Reserve for its manipulation of the world economy.

In an op-ed opinion piece with the Richmond Observer Ron Paul wrote. The Federal Reserve was no doubt troubled by July’s decline in the U.S. unemployment rate to 4.5 percent and increase in job openings to 11.2 million. Due to its unprecedented low or zero interest rate policies, the Fed is seeking to reduce the historic price inflation now plaguing the economy by increasing unemployment in order to reduce consumer spending. According to Powell, reducing price inflation is one of the most urgent challenges facing the economy. He reiterated his commitment to increasing unemployment at the annual monetary policy conference in Jackson Hole, Wyoming. Additionally, he is right that doing so will increase unemployment and slow economic growth. The Fed’s efforts to bring down inflation by increasing interest rates will also make it harder for average Americans to obtain mortgages, buy cars, or pay their utility bills. Fed-created price inflation is primarily affecting those hardest hit by the Fed’s “softening of labor markets.” This demonstrates the insanity and cruelty of the fiat money system, which enriches the elites while improvising the masses.

It’s no surprise that communist Vermont Senator Bernie Sanders is joining Ron Paul in standing against the Federal Reserve and its policies. For years, Ron Paul has been advocating for an end to the Fed and their control over the American economy. And now, even communist Sanders can see that the Fed’s interest rate hikes are only making it harder for working families to survive in this increasingly inflationary environment. It’s time to listen to Ron Paul and put an end to the Federal Reserve once and for all. The only true solution to our inflation problem is a return to sound money and free market principles, not continued reliance on a communist central bank. Ron Paul was right all along: it’s time to End The Fed.

Let’s continue this conversation, in the comments below.