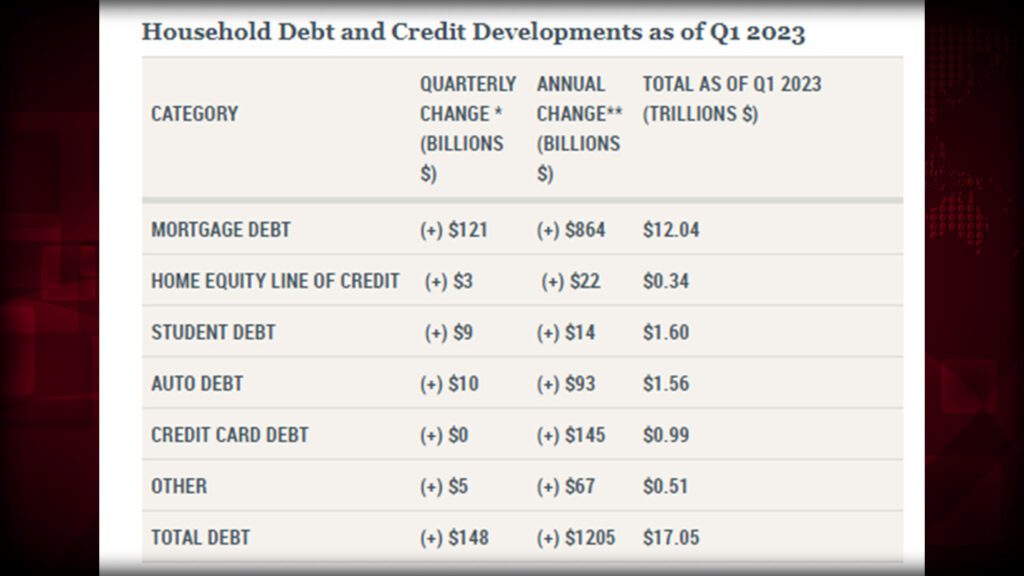

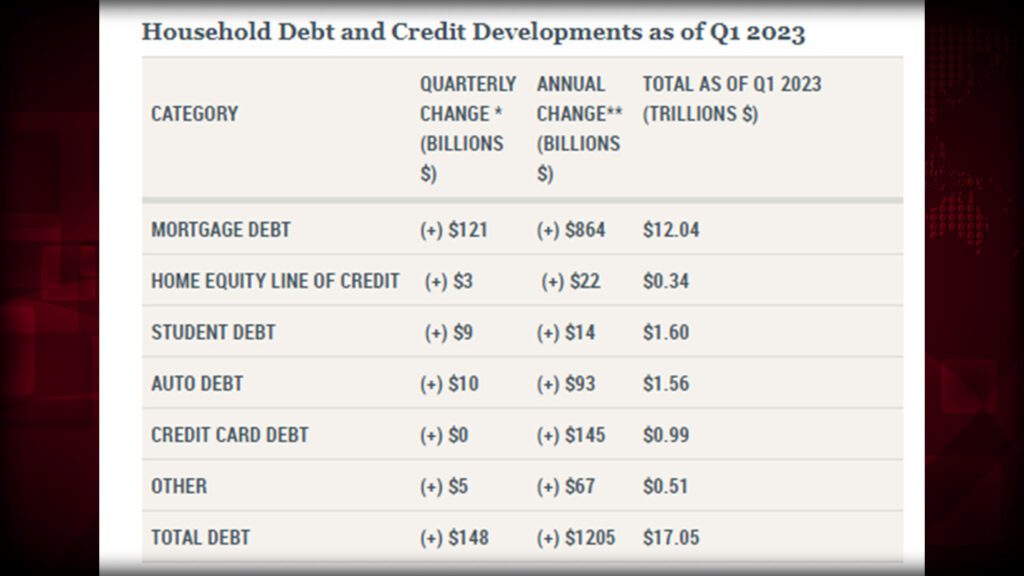

American households are drowning in debt, with balances standing $2.9 trillion higher than before the lockdown-induced recession. Mortgage delinquencies doubled over the past year, and auto and credit card delinquencies also rose. High mortgage rates, caused by actions from the Federal Reserve, have decreased affordability for potential homebuyers. Wage increases have failed to keep pace with inflation, and Americans are more pessimistic about their finances than at any time since the Great Recession. With economic growth declining to a 1.1% annualized rate in the first quarter, it is clear that the American economy is in trouble.

CTA Stay informed on the latest news and subscribe below to receive updates.

Mortgage debt, which rose $864 billion over the past year, composed 71.7% of the overall household debt increase. Automobile debt rose $93 billion, and credit card debt rose $145 billion, marking 7.7% and 12.0% shares of the broader debt increase, respectively, while student loan debt was comparatively flat. The 30-year fixed mortgage rate has risen to 6.4% as of last week, with the increases coming after the Federal Reserve hiked interest rates. High mortgage rates have significantly decreased affordability for potential homebuyers in recent months.

Median home sale prices increased from $322,600 in the second quarter of 2020 to $467,700 in the fourth quarter of 2022, according to data from the Department of Housing and Urban Development, followed by a moderate decline to $436,800 in the fourth quarter of 2023. Lower home prices in recent months come as a result of the high mortgage rates, which apply downward pressure on demand as families delay new home purchases.

Meanwhile a default on this debt means increased rates across the board.

Wage increases have failed to keep pace with inflation over the past two years, pressing consumers to finance more of their household expenditures with debt. The average age of cars and light-duty trucks on American roads has reached record levels as buyers likewise delay new purchases over elevated price levels and interest rates.

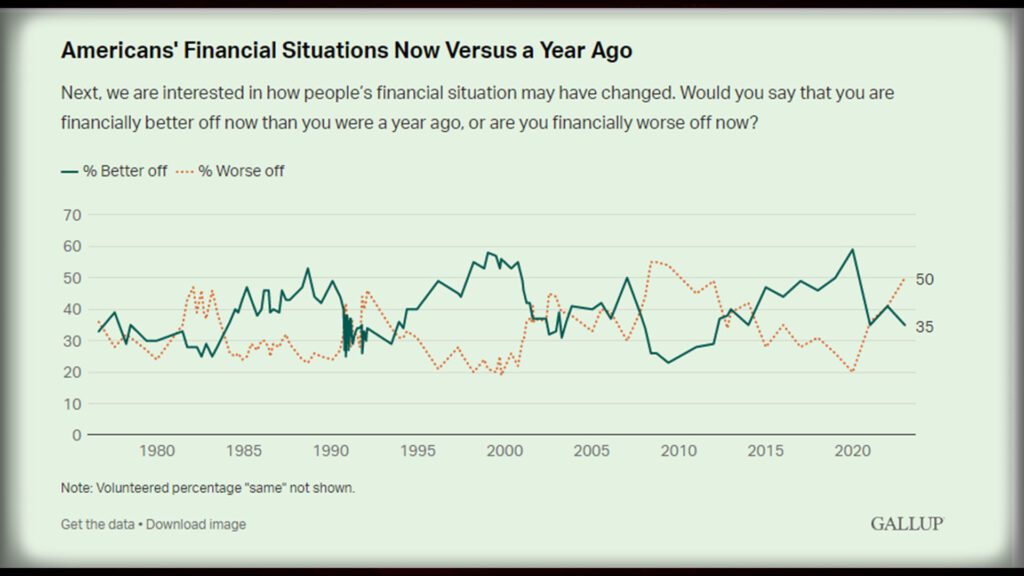

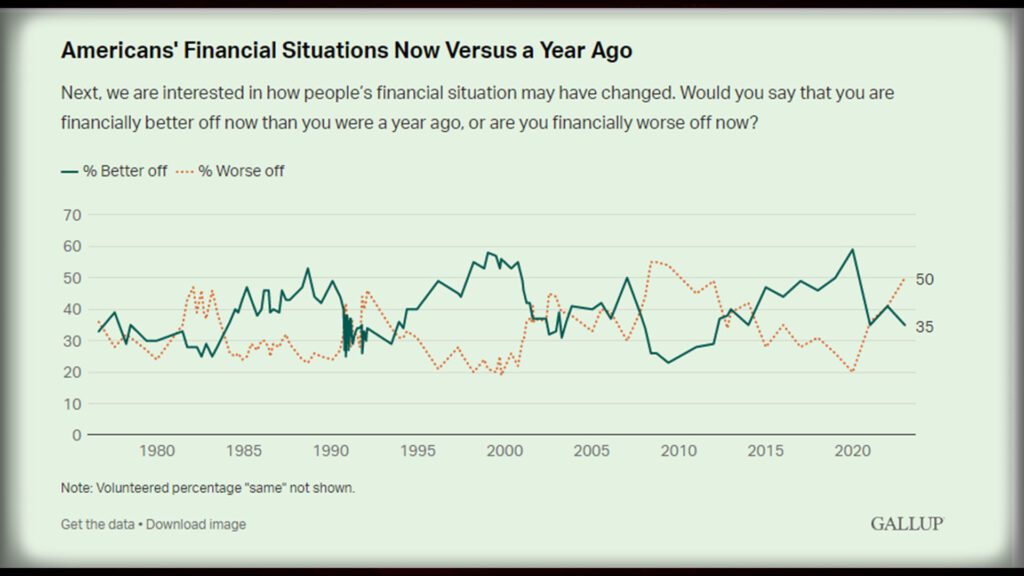

Americans are more pessimistic about their finances than at any time since the Great Recession: half of the respondents in a February survey from Gallup said they are “financially worse off” compared to one year ago, while low-income Americans were the most likely to say they have less robust finances since last year.

Economic growth declined to a 1.1% annualized rate in the first quarter, marking a significant decrease as economic headwinds slow recovery from the recession and the interest rate hikes decrease consumer demand, according to an estimate from the Bureau of Economic Analysis.

Joe Biden’s destructive economic policies have plunged American households into an unprecedented debt crisis, with balances soaring $2.9 trillion higher since the recession. Delinquencies for mortgage, auto, and credit card debt have doubled, while high mortgage rates caused by the Federal Reserve have made homes unaffordable. Wage increases have failed to keep up with inflation, leaving families struggling. Americans’ financial optimism is at its lowest since the Great Recession, and economic growth has plummeted to a mere 1.1% annualized rate. Biden’s incompetence has left a trail of destruction, decimating the American economy and leaving its citizens in despair.

Let’s continue this conversation, in the comments below.