Is the IRS stockpiling weapons with your hard-earned money? Senator Joni Ernst is on a mission to expose the IRS’ misuse of taxpayer dollars. Discover the shocking truth behind the IRS’ multimillion-dollar armament and why Senator Ernst is leading the fight to disarm the taxman.

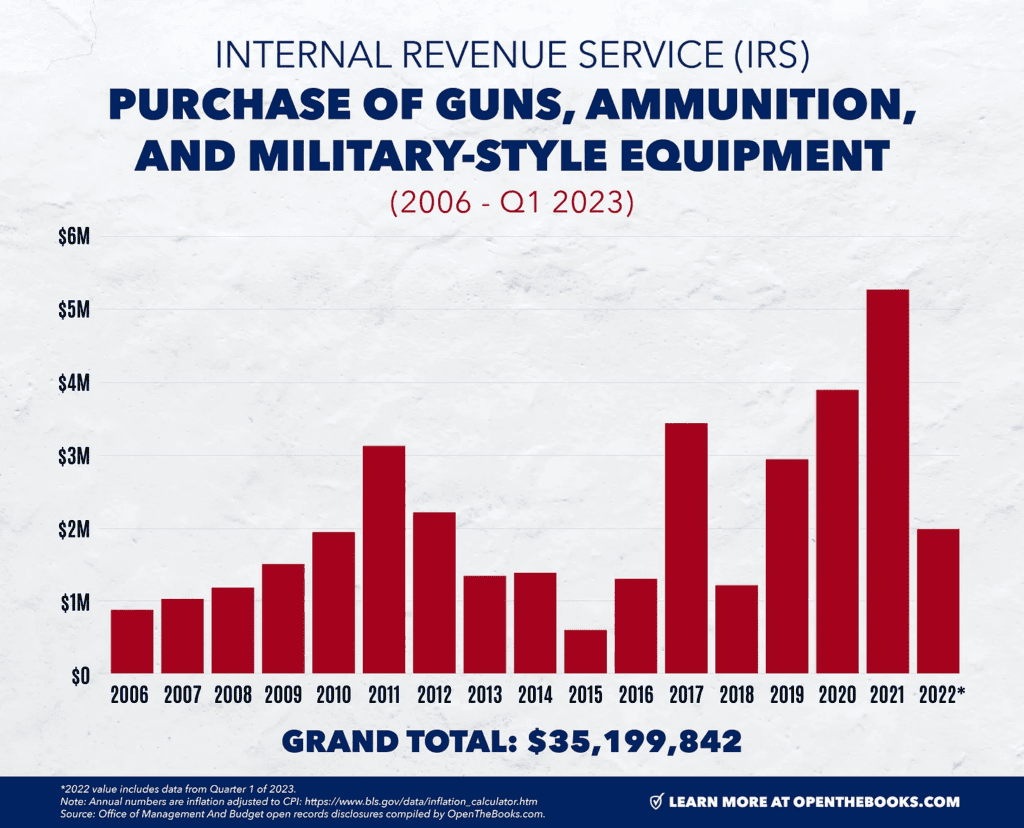

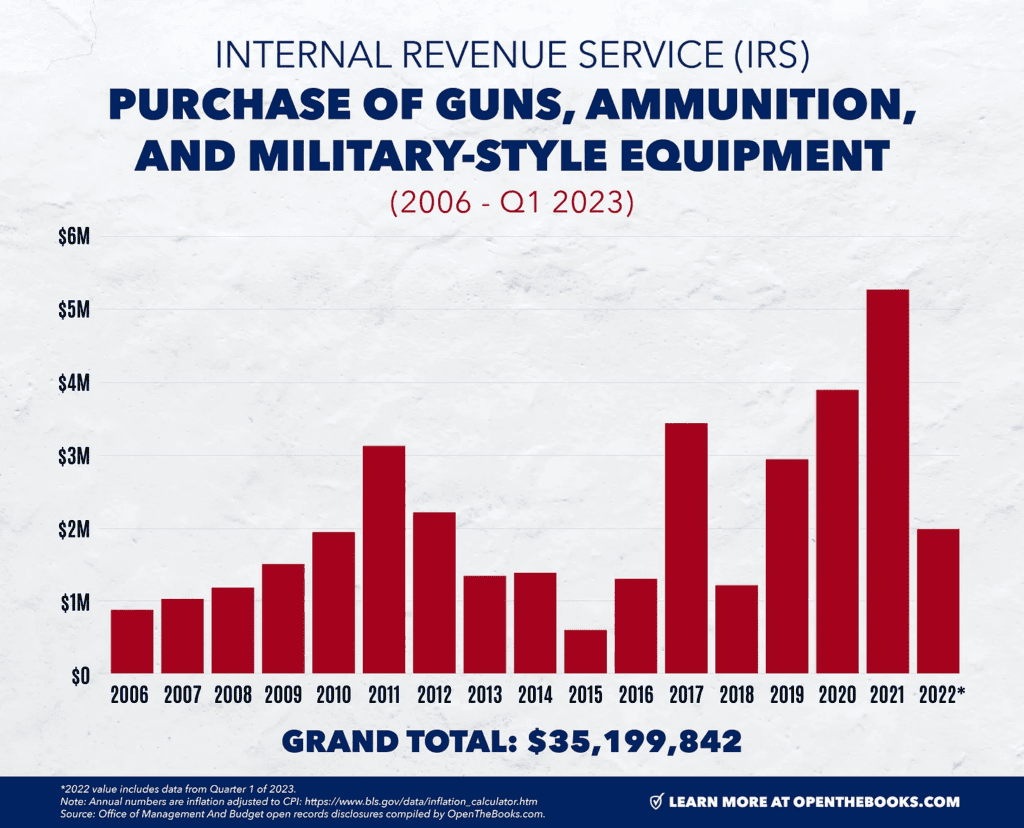

U.S. Senator Joni Ernst (R-IA) has launched a bold initiative to address a concerning issue: the IRS’ extravagant spending on weapons and tactical gear. A recent report by Open the Books revealed that the IRS has squandered over $35 million of taxpayer funds since 2006 on firearms, ammunition, and other militarized equipment for its investigation division.

The past three years alone have seen the IRS lavishly splurge, with $2.5 million being allocated for ballistic shields and other gear for criminal investigation agents. The taxman acquired ballistic helmets, body armor vests, and even Smith & Wesson rifles and Beretta 1301 tactical shotguns, costing taxpayers nearly $1 million. This exorbitant spending raises a critical question: why does the IRS need such firepower in the first place?

Senator Ernst echoed the public’s concern, emphasizing the importance of scrutinizing the IRS’ activities. “The taxman is fully loaded and funded by the taxpayer,” she declared in an exclusive interview with Townhall. “The important question remains, why does the IRS even have or need weapons?” Senator Ernst’s new bill, aptly titled the “Why Does the IRS Have Guns Act,” aims to halt this questionable spending.

The proposed legislation stipulates that no funds authorized for any fiscal year may be used by the IRS commissioner to purchase, receive, or store firearms or ammunition. Furthermore, it demands the transfer of all IRS-owned firearms and ammunition to the General Services Administration (GSA). Once under the GSA’s control, these items will be sold or auctioned off to licensed dealers and the general public.

Crucially, any proceeds from these sales will be deposited into the general fund of the Treasury, with the sole purpose of reducing the deficit. This common-sense approach ensures that the excessive spending of the IRS is curbed and that taxpayer money is put to better use.

WHY DOES THE IRS NEED GUNS?

— OpenTheBooks (@open_the_books) May 1, 2023

Our findings: https://t.co/vOIjIeyaqp

The Militarization Of The IRS – The Facts On The Purchase Of Guns, Ammunition, And Military-Style Equipment Since 2006. pic.twitter.com/M8ImRzczna

Senator Ernst’s bill doesn’t stop there. It also seeks to relocate the authorities, functions, personnel, and assets of the IRS’ Criminal Investigation Division to the Criminal Division of the Department of Justice. This move would establish a distinct entity within the DOJ to oversee the IRS’ investigation activities, providing greater transparency and accountability.

In her conversation with Townhall, Senator Ernst expressed her steadfast commitment to protecting hardworking Americans from the IRS’ abuse of power. She proudly stood against the IRS’ targeting of small businesses in the past and now aims to prevent further misuse of taxpayer dollars.

It’s time to put an end to the IRS’ abuse of power and wasteful spending. Senator Joni Ernst’s legislation is a crucial step in disarming the taxman and ensuring taxpayer funds are used responsibly. Join the fight to protect Americans from an overreaching bureaucracy. Stay informed, stay empowered!