Something is awry. Millions of distressed Americans, grappling with the harshest inflation tempest in decades, are feverishly searching for “pawn shop near me” on Google. This startling surge, a grim testament to the economic hardship many face, coincides with what some are calling the failure of ‘Bidenomics.’ Could it be that the nation, burdened by years of negative wage growth and record credit card debt, has resorted to pawning their precious items? The profound implications of this trend warrant a closer look, as it portends a potential crack in the American consumer’s financial resilience.

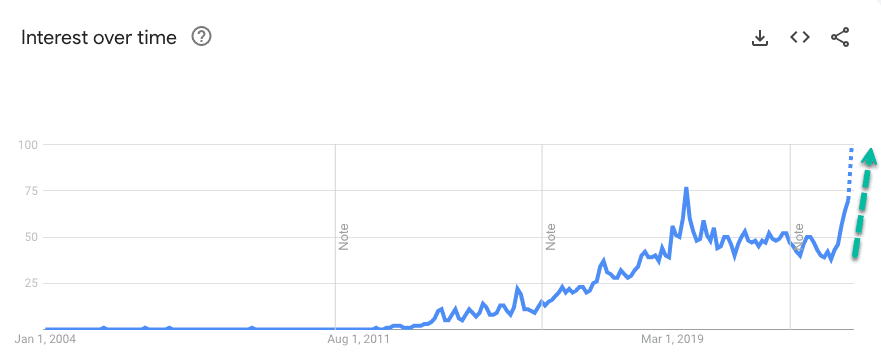

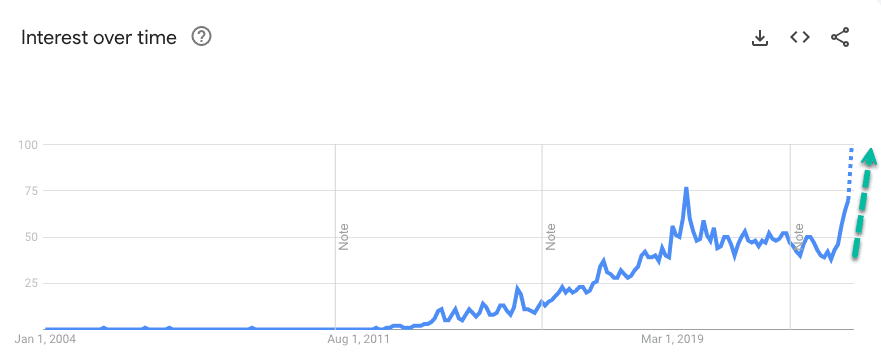

January 2023 marked the start of an ominous trend. Google search data began documenting an unprecedented surge in people looking up “pawn shop near me,” reaching a record high in early July. The sudden spike paints a bleak portrait of cash-strapped Americans, seemingly resorting to pawning items for immediate financial relief amid spiraling inflation.

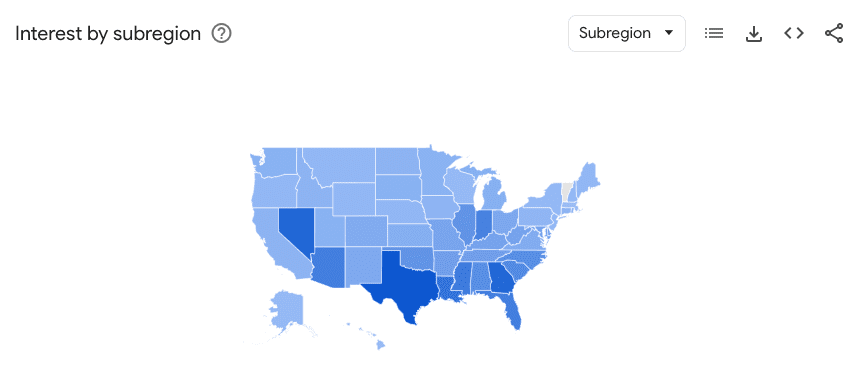

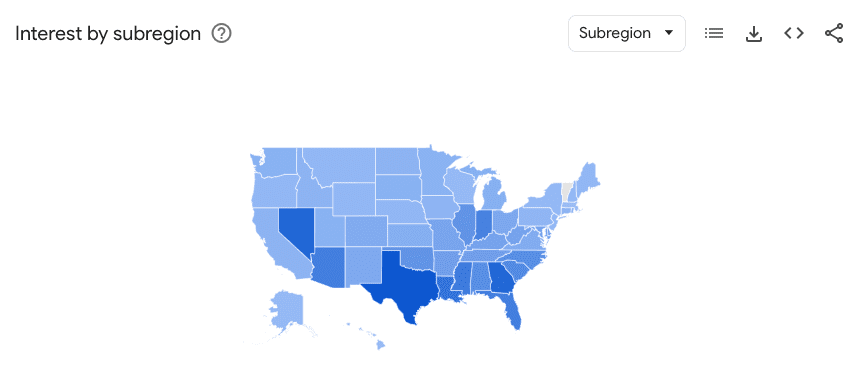

Search interest isn’t confined to one region—it’s nationwide, with a significant concentration in the Deep South. The fact that such a vast number of individuals across the country are considering selling their possessions signifies a deep-seated panic. Americans are battling more than two years of negative real wage growth, and the supposed solutions offered by Biden’s economic policies seem ineffective.

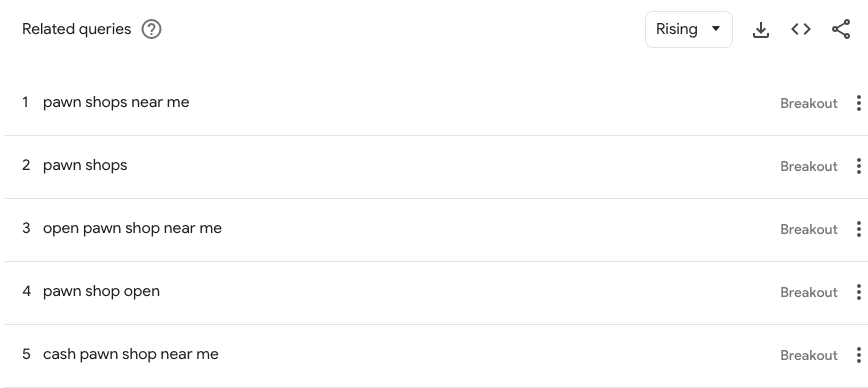

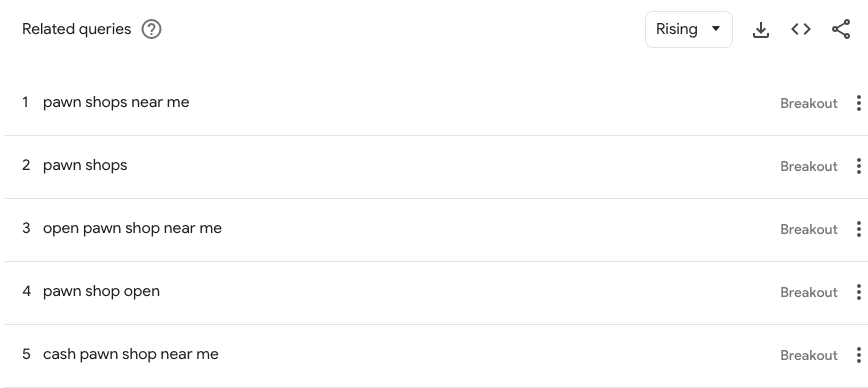

The associated search terms provided by Google—like “pawn shop,” “open pawn shop near me,” “pawn shop open,” and “cash pawn shop near me”—are all experiencing a breakout surge. This could suggest that people are not just contemplating pawning, but are actively seeking open establishments where they can exchange their possessions for cash.

Are we witnessing the tangible fallout of ‘Bidenomics’? Households, once perhaps optimistic about their financial future, have been drained of savings and plagued by soaring credit card debt. Consumers’ purchasing power has dwindled under the burden of the highest interest rates in a generation. Consequently, selling off their possessions could be one of the few lifelines left to keep them afloat.

Remember the shopping spree during the stay-at-home orders? The purchases made then, possibly on credit, could now be part of the collateral damage of the inflation storm. The items bought during the ‘Covid boom,’ ranging from fitness equipment to home entertainment, could now be finding their way into pawnshops.

The signs of weakening consumer strength are becoming hard to ignore. Even corporations are taking notice. Giants like General Mills and Walgreens Boots Alliance recently warned about a softening consumer. Could this new development serve as further evidence that the consumer foundation is cracking?

Adding to the concern, Goldman’s Rich Privorosky conveyed a startling sentiment to clients last month, highlighting that “something is not quite adding up on the consumer.” His question, “Have we just run out of excess savings and are we returning to replenishing savings?” hits a nerve. Indeed, many are questioning whether we are witnessing the depletion of Americans’ financial resilience and the advent of a new era of austerity.

But, is this a temporary blip, or does it indicate a more profound shift in consumer behavior? Given the backdrop of Biden’s policies, the answer is essential for our understanding of America’s economic trajectory.

The government’s economic strategies are primarily built around stimulating demand to fuel economic growth. However, this increase in pawn shop searches suggests a stark deviation from that goal. It’s as if something has snapped in the economy, causing the consumer, the engine of American growth, to stall.

Despite all the relief measures put in place, consumers seem to be buckling under the pressure. The sheer desperation in selling off possessions reflects a lack of confidence in the immediate future and points towards a larger systemic issue.

The long-term implications of this trend could be devastating, with potential ripple effects on businesses and the overall economy. If consumers continue to feel the squeeze, their spending is likely to remain subdued, inhibiting economic recovery and leading to an adverse cycle of low spending and slow growth.

The startling rise in Google searches for “pawn shop near me” unveils a troubling side of the American economy, starkly contrasting the hopeful narrative presented by the Biden administration. It’s a clear distress signal, warning of the dire straits consumers find themselves in. The desperation to pawn goods, a survival tactic more synonymous with economic crashes than recovery, paints an alarming picture of the current state. Unless swift action is taken to address the root causes—rising inflation, dwindling real wages, and burdensome debt—the strain on consumers could evolve into a full-fledged economic crisis. The alarm bells are ringing; is anyone listening?