In what can only be described as a stark warning for the American dream, a groundbreaking Thursday report from real estate data giant ATTOM, unveils a devastating reality: the average American citizen can no longer afford a home in nearly 99 percent of our nation. The dream of homeownership is slipping further away, beckoning an urgent reevaluation of the economic policies at play.

Buying a home now unaffordable in 99% of America, report finds https://t.co/vd5h801UKv

— GOP (@GOP) October 2, 2023

ATTOM’s study examined 578 counties across the United States and concluded that out of these, the average income earner, making an annual salary of $71,214, would struggle to afford a home in a shocking 574 of them. The company set their criterion for ‘affordability’ as homeowners not having to spend more than 28 percent of their salaries towards housing costs.

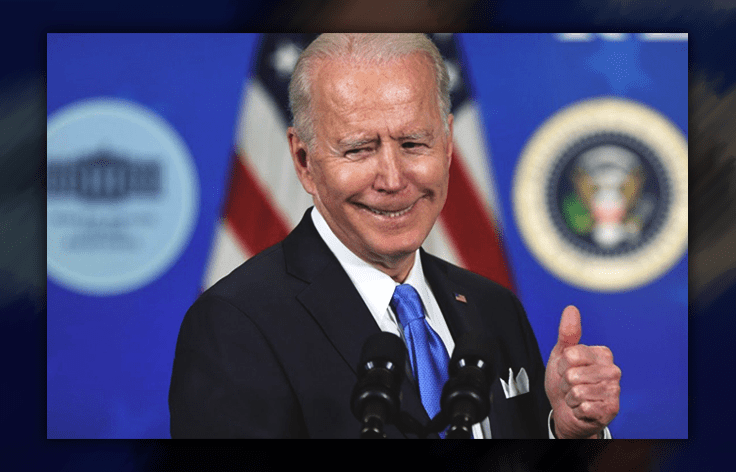

On the heels of this disturbing report, America faces the highest mortgage rates in decades. The once-touted ‘consumer-friendly’ 30-year fixed-rate home loan interest rates soared to a startling 7.09 percent last month. It’s a direct result of the inflation that has been rampaging under President Joe Biden’s watch—an uncomfortable truth that may carry significant political repercussions.

Political polls are offering Biden a grim prognostication. A significant precursor to a potential presidential loss is indicated by a CBS poll this month which revealed that 71 percent of Americans, whose finances are worse-off since the pandemic, would lean toward voting for former President Donald Trump over Biden. A mere 28 percent favored the current president.

Additionally, findings from a separate CBS poll unravel the root cause of this sentiment, as 50 percent of voters believe that Biden administration’s economic measures are pumping fuel into the inflationary fire. A view that is backed by a Federal Reserve Bank of San Francisco study, attributing Biden’s nearly $2 trillion stimulus package to worsening inflation, as reported by the Washington Free Beacon.

As Bloomberg reporter Mark Niquette pointed out, such news reminds voters that under Trump’s presidency, conditions were better—homes were more affordable. This comparison has proven to be a thorn in the side for the current administration.

Meanwhile, Biden’s vice president Kamala Harris, when discussing the decrease in homeownership, conveniently chose to ignore inflation. In an eyebrow-raising move, she introduced a different scapegoat: “climate anxiety.”

This is the economic reality Americans are living through—a daily battle against inflation, disillusionment from self-serving political narratives, and the dream of homeownership steadily fading away.

America, amid this bleak housing crisis and rocketing inflation, stands at the precipice of an economic and political transformation. The analysis from ATTOM lays bare a deep discrepancy between the rhetoric from the White House and the crushing realities on Main Street.

The current administration bears the brunt of an urgent demand: to face economic truths and to frame appropriate policies based on economic realities rather than potentially misplaced climate concerns. The future of the American dream, and indeed the political landscape, hangs in balance.

With the profound implications of these financial setbacks now in full view, one thing stands clear – the cost of ignoring economic realities and economic mismanagement is high – it’s the American Dream.