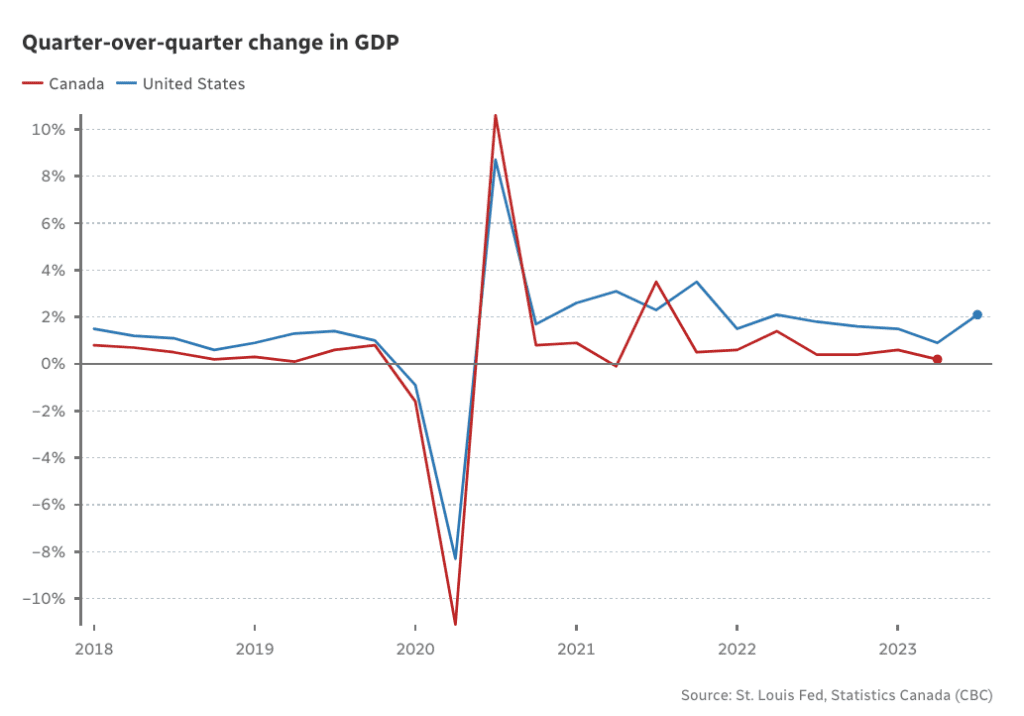

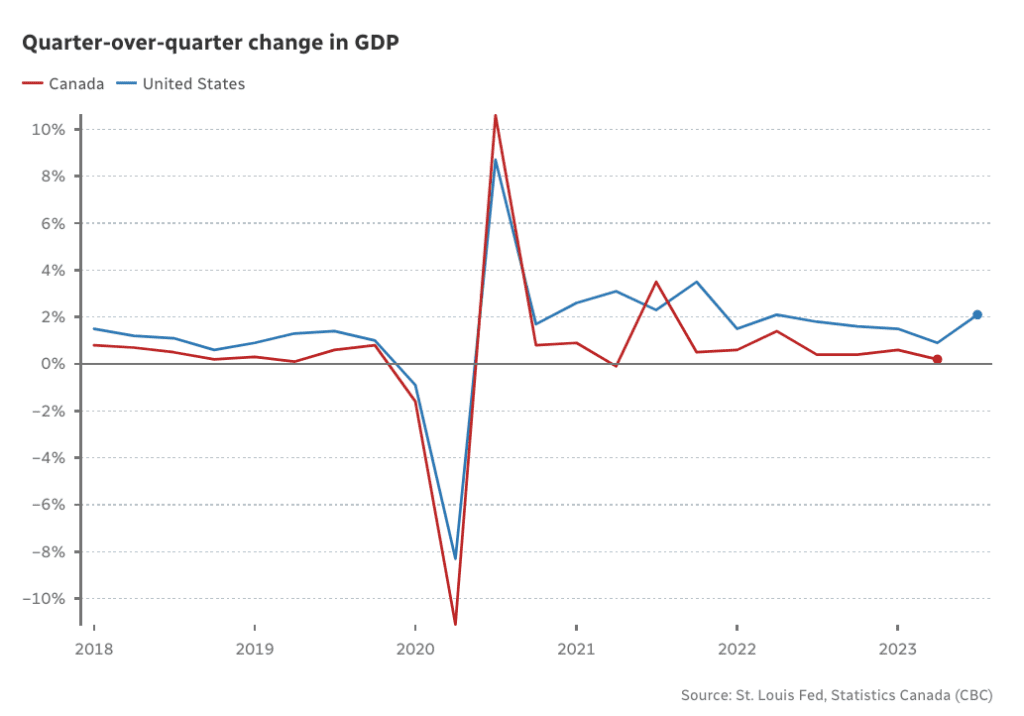

As economists scrutinize the latest data, a stark contrast emerges between the economies of the U.S. and Canada. Both nations are making strides in the battle against inflation and boast strong employment levels, but that’s where the similarities end. The American economy is surging with a 4.9% growth, while Canada’s economic progress has hit a wall, flatlining in comparison.

But don’t be fooled by the numbers alone. Experts like Royce Mendes, the managing director at Desjardins Capital Markets, warn that the reality is grimmer than it appears. Canada’s economy is buoyed by explosive population growth, masking underlying issues. Without this demographic boost, Canada’s economic situation would be dire.

So, why the divergence between these North American allies?

Two critical factors are at play: one rooted in Canadian economics, the other a surprise American development.

Firstly, higher interest rates are wreaking havoc in Canada more so than in the U.S. With Canadians shouldering heavier debt loads and facing more frequent debt renewals, rising borrowing costs have a swift and severe impact. In contrast, most Americans enjoy 30-year mortgages, cushioning the blow of interest rate hikes. Consequently, Canadian households are tightening their belts, bracing for mortgage renewals by cutting spending and hoarding savings. Meanwhile, Americans are spending more and saving less, with the U.S. economy benefiting from their reduced caution.

But interest rates alone don’t account for the stark economic disparity. Douglas Porter, chief economist at the Bank of Montreal, points to the U.S. government’s spending spree. Initiatives like the Bipartisan Infrastructure Deal, the CHIPS and Science Act, and the Inflation Reduction Act have injected trillions of dollars into the economy. This “sugar rush” of fiscal spending has propelled the U.S. economy, resulting in growth surpassing last year’s performance.

Canada’s economic script reads differently. Recent data revealed a shrinking deficit, a modest improvement. In contrast, the U.S. is facing a staggering $1.695 trillion budget deficit under the Biden administration, a 23% increase from the previous year. This fiscal push, while currently bolstering growth, is not sustainable. Experts predict a slowdown in the U.S. economy as early as the fourth quarter of this year, potentially peaking too soon before the 2024 presidential election.

Both nations face unique challenges and advantages in monetary policy. The U.S., riding the wave of current GDP growth, may have to delay rate cuts to prevent fuelling inflation. Canada, however, could see rate cuts sooner, with forecasts indicating a reduction in the second half of the next year.

The fiscal and monetary policies of both countries are on a tightrope, balancing economic growth against inflation. As Bank of Canada governor Tiff Macklem cautions, alignment between monetary and fiscal policy is crucial to curb inflation. Meanwhile, Jerome Powell, chair of the U.S. Federal Reserve, highlights the encouraging signs of the American economy, though he acknowledges the need for sustained evidence of inflation reduction.

The economic fates of these neighbors are diverging: the U.S. is experiencing a boom that may wane as election season approaches, while Canada, teetering on the brink of recession, may witness a revival potentially timed with a federal election in 2025. The question looms: Which nation will navigate the economic tightrope more successfully?