In a surprising turn of events ahead of the festive season, consumer spending has taken a noticeable dip. The latest data from the CNBC/NRF Retail Monitor reveals a slight decline in October retail sales, excluding autos and gas, by 0.08%, and a 0.03% fall in core retail sales, which also excludes restaurants.

This new Retail Monitor, a collaborative effort between CNBC and the National Retail Federation, leverages insights from Affinity Solutions, a prominent player in consumer purchase analysis. It draws from an extensive pool of over 9 billion annual credit and debit card transactions, representing more than $500 billion in sales, issued by over 1,400 financial institutions.

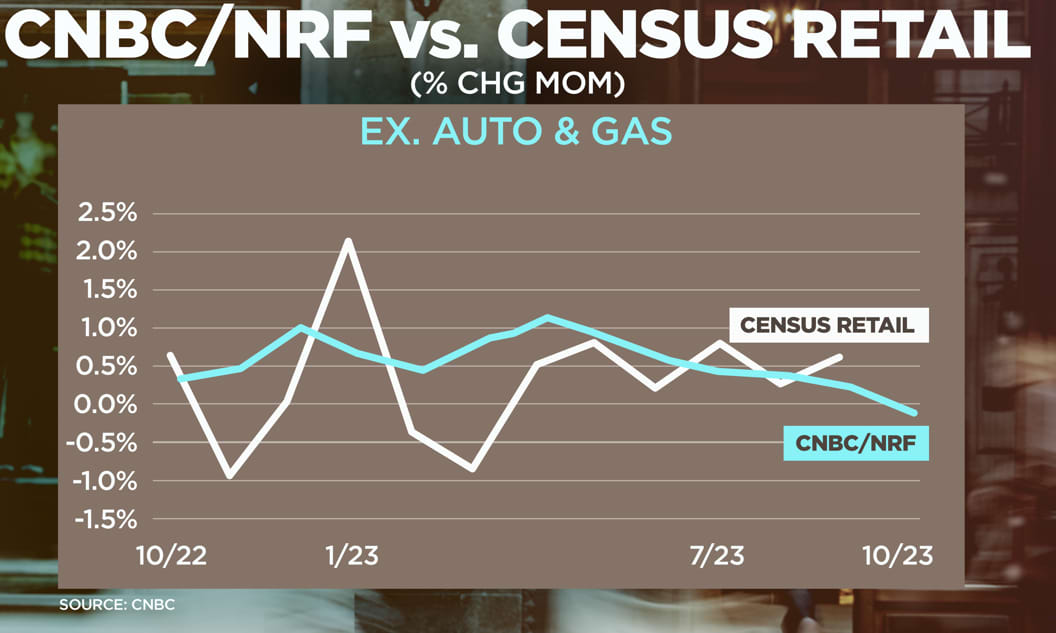

This data, offering a real-time snapshot of consumer behavior, stands in contrast to the Census Bureau’s retail sales report, which is based on survey data and often subject to revisions. The CNBC/NRF Retail Monitor, rooted in actual consumer purchases, provides a more immediate and unaltered reflection of the retail landscape, albeit with seasonal adjustments similar to those used by the Census.

Matthew Shay, NRF President and CEO, highlights that this monitor will revolutionize the tracking and understanding of retail sales. It aims to provide nuanced insights into consumer spending patterns, benefiting a wide audience from investors to retail executives.

Dan Colarusso, CNBC Senior Vice President of Business News, emphasizes the depth and dynamism of these insights, which go beyond simple headline figures to unearth emerging trends and crucial details.

The October data signals a cooling in consumer expenditure, aligning with Wall Street’s expectations. Notably, there was a downturn in sales in areas such as electronics, appliances, furniture, and home stores, while sectors like sporting goods, hobby stores, and online retail saw an uptick.

This move towards real, high-frequency private sector data for economic assessment, which gained momentum during the Covid pandemic, continues to grow. The Retail Monitor is poised to offer detailed demographic breakdowns of spending patterns in the coming months, marking a new chapter in retail intelligence. According to Jonathan Silver, founder and CEO of Affinity Solutions, this approach not only serves as a resource but as a strategic guide to understanding and engaging with today’s consumer.