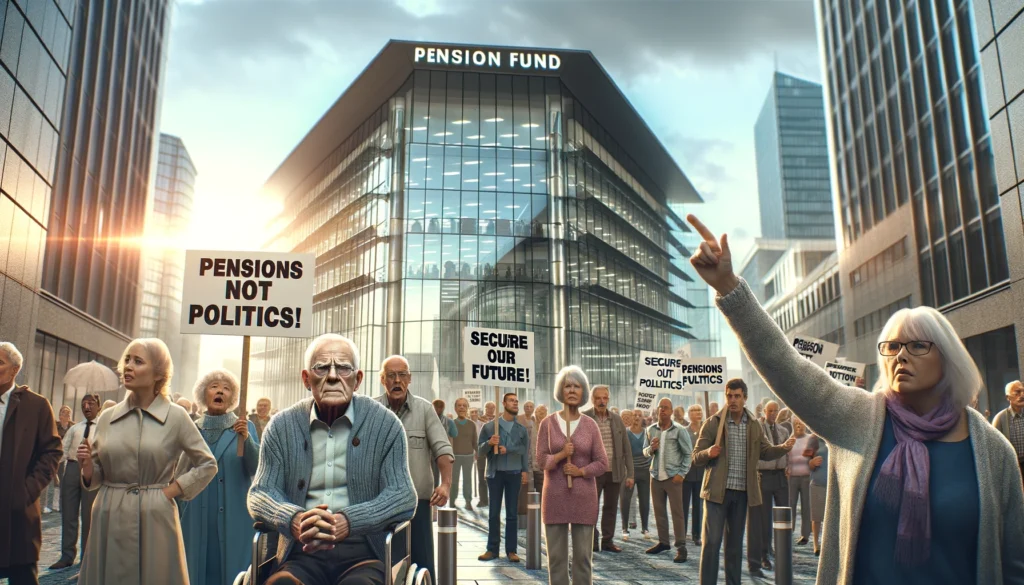

In a groundbreaking announcement on Tuesday, the State Financial Officers Foundation revealed a new initiative to counteract the use of pension funds for supporting leftist political causes. Joined by Utah Treasurer Marlo Oaks (R), the foundation has established the Public Fiduciary Network, aiming to raise awareness about the politicization of public pension funds and how they are used to drive Environmental, Social, and Governance (ESG) initiatives. This critical issue affects approximately 5,000 state and local pension funds across the United States, controlling trillions of dollars in assets.

Noah Wall, the executive director of the State Financial Officers Foundation, spoke at a press conference in Florida, stating, “Our goal is to provide education and resources for [pension boards] to understand the scope of the problem in the financial industry, the level of politicization of these funds, and to understand very clear ways that they can protect the fiduciary duty with respect to how they’re managing and overseeing these pension funds.” Utah Treasurer Marlo Oaks, acting as the network’s national chair, emphasized the importance of educating individuals on state and local pension boards on the efforts of asset managers to back certain political agendas, thereby influencing the direction of capital markets.

Oaks called for pension fund managers to return to the traditional understanding of fiduciary responsibility, in which political agendas do not impact investment strategies. This call for change comes in the wake of a report by the American Accountability Foundation, which exposed that Oklahoma public official retirement funds were being utilized to promote decarbonization, racial audits, and pro-abortion policies, with at least 216 ESG-related proposals being backed using public retirement funds.

When questioned on the geographic focus of the network, Wall affirmed their intent to recruit partners at every level across the country, stating, “It’s a 50-state issue. We’ll be working on recruiting members in states from around the country. It’s not a red state or blue state problem. This is a national issue. We’re going to be recruiting everyone down to the county commissioners that oversee local pension boards.”

The State Financial Officer Foundation CEO, Derek Kreifels, highlighted the urgency of raising awareness as giant asset managers like BlackRock intensify their lobbying at the state and local levels. Kreifels accused BlackRock of sending mixed messages about its commitment to ESG investments, noting that its stance “depends on who’s in the room and who they’re talking to.”

This crucial development comes as states have been increasingly blocking state funds from going through asset managers targeting the oil and gas industry. The establishment of the Public Fiduciary Network represents a significant step towards countering the politicization of public pension funds and ensuring that fiduciary duty is maintained in investment strategies. As we face an era of heightened political agendas and the potential misuse of trillions of dollars in pension funds, the urgent and authoritative actions of the State Financial Officers Foundation and its allies provide a beacon of hope for upholding traditional fiduciary responsibilities and safeguarding the interests of all citizens.