With Moody’s Chief Economist discussing the impact of federal rate hikes, many wonder what the future of banking holds.

It is increasingly clear that economy experts are worried about high inflation and its effect on banks as wage earners struggle to make ends meet while prices continue to climb.

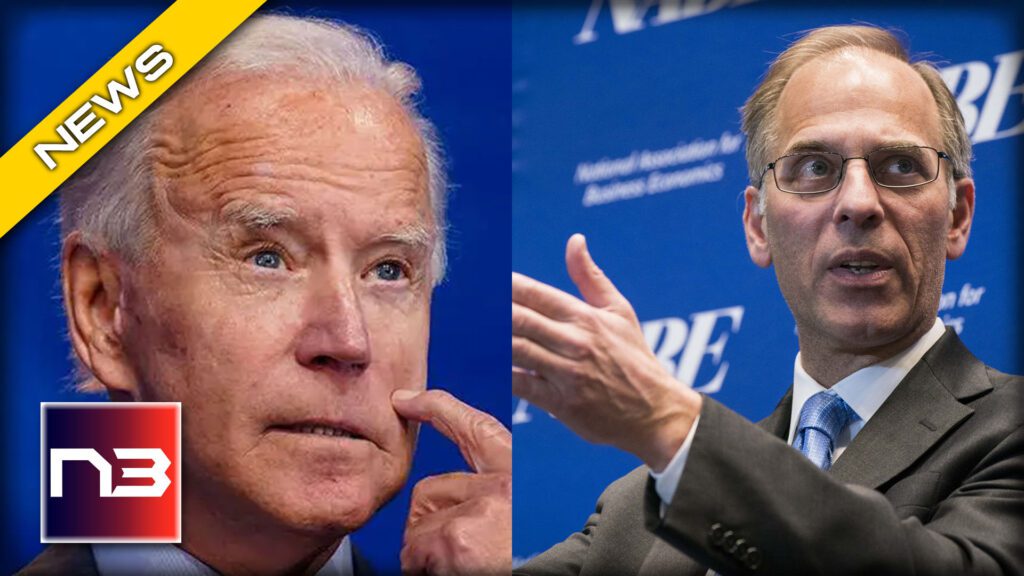

Breitbart reports, Moody’s Analytics Chief Economist Mark Zandi told CBS News on Tuesday that the problems in the banking industry are the inevitable result of Federal Reserve rate hikes, which will cause “things to start wobbling and breaking and make you uncomfortable.” It is expected that inflation will remain high for the next 12-18 months..”

To add to the confusion in the current banking crisis, and ongoing inflation war of attrition Janet Yelen made a statement that raised some eyebrows.

Bloomberg reports. Regulators don’t want to provide “blanket” deposit insurance without working with lawmakers, and heads of recently failed American banks should be held accountable, Treasury Secretary Janet Yellen said.

In response to the failures of Silicon Valley Bank and Signature Bank, some banking groups have asked the Biden administration and the Federal Deposit Insurance Corp to temporarily guarantee all U.S. bank deposits.

The economy continues to slump as rising Federal rates lead banks into turmoil and leave many of us feeling clueless about the future. Moody’s chief economist revealed that inflation was expected to stay high for the next twelve to eighteen months, leaving many of us in the political divide asking: will the banking recession last another year and a half? The answer is still uncertain, but it’s clear that sustainable growth cannot come from high inflation when there is a divide between wages and prices. It’s shameful to know that corporate greed has been given an opportunity while hardworking Americans suffer economically. We should be aiming higher, not allowing our economy to fail because of a few people at the top profiting off our backs.

Let’s continue this conversation, in the comments below.