Despite mainstream media’s cheerleading efforts following the latest Federal Reserve announcement, ordinary Americans endure the reality of a hurting economy and stagnant interest rates. CBS News and NBC News may paint rose-colored visions of economic stability, but the painful truth lies in the hardship average Americans encounter daily.

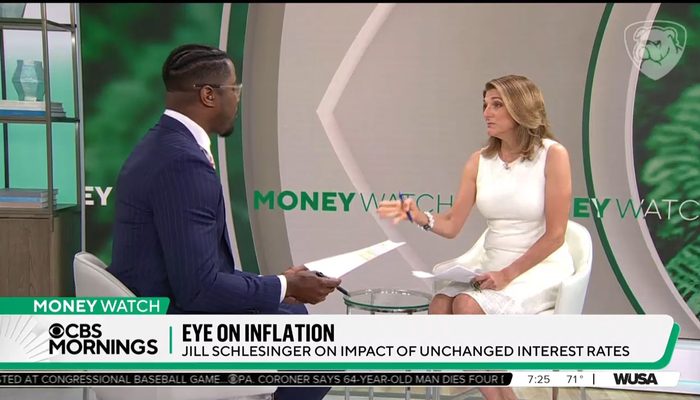

Business analyst Jill Schlesinger illustrated her detached grasp of the situation by trivializing the raised prices of everyday necessities. It’s true, certain categories saw a minor decline last month. “Gas prices! Yay!” she said enthusiastically, with similar cheery statements about the clothing and car markets. “Groceries were flat,” she said as if that was something to celebrate.

But aren’t we forgetting something? The less than one percent dip in certain categories fails to cover the larger issue. Prices remain terrifyingly high for necessities like housing and insurance. This hints at an ignored problem, glossed over with a thin veneer of positivity.

Schlesinger alluded to but failed to address in-depth, the root cause of this pain: prices are 22 percent higher than four years ago. “That’s why you don’t feel crazy if you say like I know it’s getting better, but it still hurts,” she said, calmly.

Dr. Thomas Hoenig, former president of the Reserve Bank in Kansas City and former vice-chairman of Federal Deposit Insurance Corporation, painted a less rosy image. He stated outright that as long as rates stay as they are, inflation will remain in the three percent range for the foreseeable future. Meaning, for common folks, relief appears to be nearly half a decade away.

NBC’s Today senior business correspondent Christine Romans also sang praises for negligible decreases in inflation. But she carefully sidestepped mentioning the actual dip in clothing prices, a mere 0.6 percent, surely not worth the celebration. Her snide comments suggesting that average Americans would be thrilled because their “fast food lunch is cheaper,” suggests a glaring disconnect from the realities plaguing everyday patrons.

This kiddie-pool dip hardly signifies economic success, especially when the truth is that under the Biden Administration, inflation sits at a 40 percent high. Sadly, the long-awaited sigh of relief isn’t on the horizon anytime soon, despite what the mainstream media wants you to believe.

To dare to offer hope of financial comfort when prices are higher than ever, and levels of inflation have skyrocketed under the current administration, is not only misleading but highly insensitive. As we continue to weather this storm, let’s remember that rose-colored glasses don’t suit a country up to its neck in rising inflation.