Whoever thought that the new 87,000 IRS agents were for going after the wealthy was stuck in some fantasy land, with the IRS unveiling a new program it is clear who they were going to go after for additional taxes.

It seems the government has hit rock bottom in its latest initiative to “tax the rich”. The Democrats have passed a bill to hire an additional 87,000 IRS agents while they simultaneously introduce a “tip reporting program” meant to target working class servants such as waitresses.

We Love Trump reports. Socialists tell us to tax the rich.

However, the Democrats passed the Inflation Reduction Act, which added 87,000 IRS agents.

Rich people won’t be targeted by those agents.

The working class will be their target.

You can expect the IRS to come after your waitress who survives solely on tips.

On Monday, the IRS introduced a “voluntary tip reporting program between the IRS and employers in various service industries.”

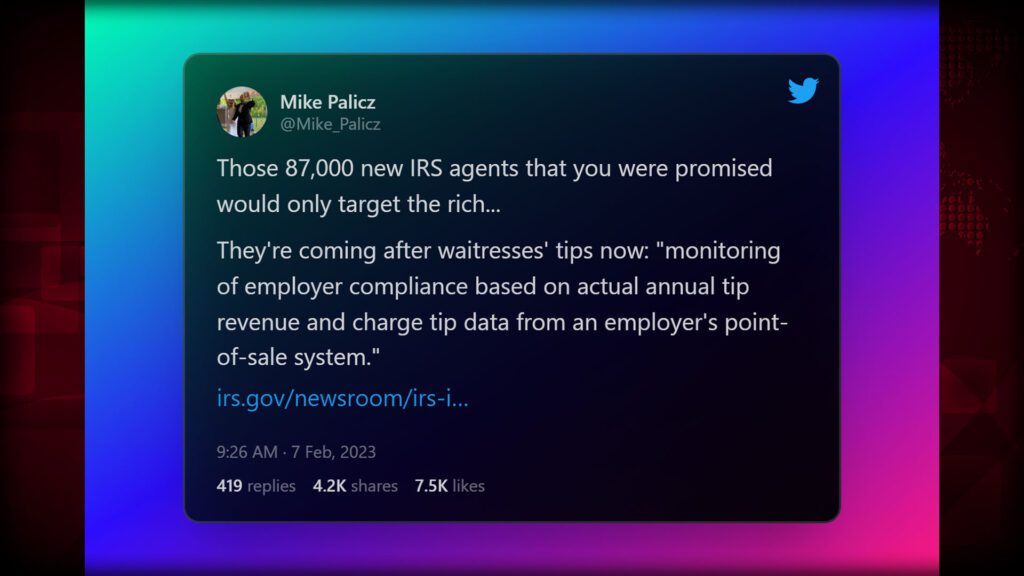

Mike Palicz stated on twitter “Those 87,000 new IRS agents that you were promised would only target the rich… They’re coming after waitresses’ tips now: “monitoring of employer compliance based on actual annual tip revenue and charge tip data from an employer’s point-of-sale system.”

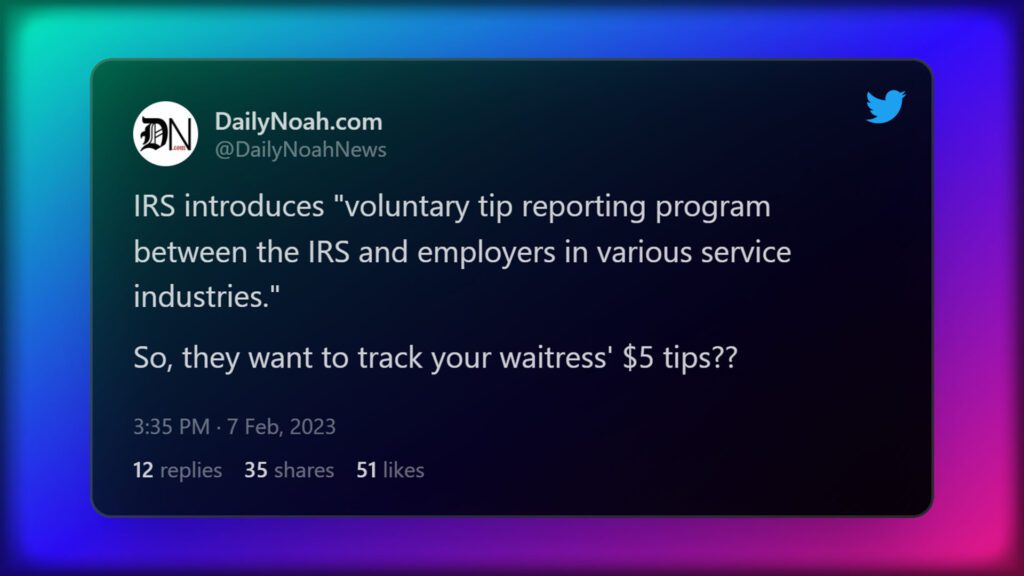

Daily Noah tweeted “IRS introduces “voluntary tip reporting program between the IRS and employers in various service industries. So, they want to track your waitress’ $5 tips??”

The new IRS initiative was outlined on the IRS website and it stated. Today, the Treasury Department and Internal Revenue Service issued Notice 2023-13, which contains a proposed revenue procedure for establishing the Service Industry Tip Compliance Agreement (SITCA), a voluntary tip reporting program between the IRS and employers in various service industries. This guidance is being issued in proposed form to allow the public to comment.

To improve tip reporting compliance, the proposed SITCA program takes advantage of advancements in point-of-sale systems, time and attendance systems, and electronic payment settlement methods. Moreover, the proposed program would reduce taxpayer and IRS administrative burdens and provide more transparency and certainty to taxpayers.

The IRS proposed The monitoring of employer compliance based on actual annual tip revenue and charge tip data from an employer’s point-of-sale system, and allowance for adjustments in tipping practices from year to year.

Additionally as a bribe the IRS offered this to employers. Participating employers have flexibility to implement employee tip reporting policies that are best suited for their employees and their business model in accordance with the section of the tax law that requires employees to report tips to their employers.

For months we have been told that the government is on the prowl for wealthy tax dodgers, but it turns out they are much more interested in everyday Americans. Now under Biden’s so-called “Inflation Reduction Act” they have added 87,000 IRS agents to hunt down already struggling citizens. Yesterday, we found out why as the IRS has introduced a voluntary tip reporting program that will be used to squeeze even more taxes out of those struggling waiters and waitresses who live off their tips. We all knew that government monopolies offer services beyond help, but with this over reaching initiative it has become painfully clear what Biden’s government really stands for:lies and more taxes. The only thing this latest program does is make life harder for people in an already shredded economy; it is a failed attempt by Biden at redistributing wealth.

Let’s continue this conversation, in the comments below.