In what seems to be a shocking revelation, a poll by Intelligent.com, has discovered that nearly a third of Americans burdened with student loans indulged in unanticipated spending, buoyed by the hope of loan forgiveness as promised under President Joe Biden’s plan. Their misplaced confidence, however, was abruptly shattered when the Supreme Court struck down Biden’s student loan forgiveness plan last month.

The poll, which surveyed 977 individuals qualifying for a minimum $10,000 of debt relief under Biden’s proposed scheme, unveiled that one in three respondents had spent “extra money,” betraying their assumption of impending forgiveness. Much to their dismay now, they had channeled these funds towards vacations, retail purchases, and disturbingly even towards drugs, alcohol, and gambling. Financial expert James Allen, founder of Bullpin.com, compared the abrupt disillusionment faced by borrowers to “waiting for a tax refund only to find out the IRS made a mistake.”

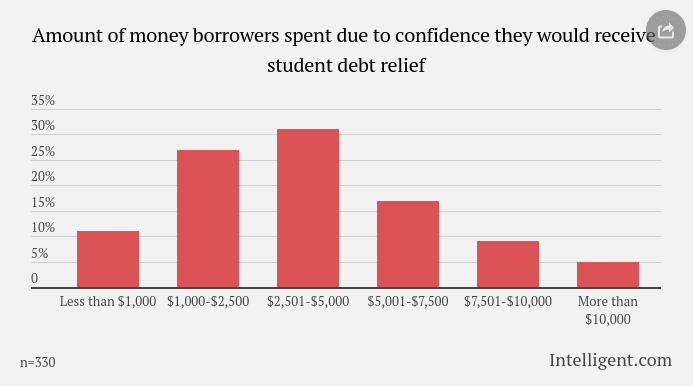

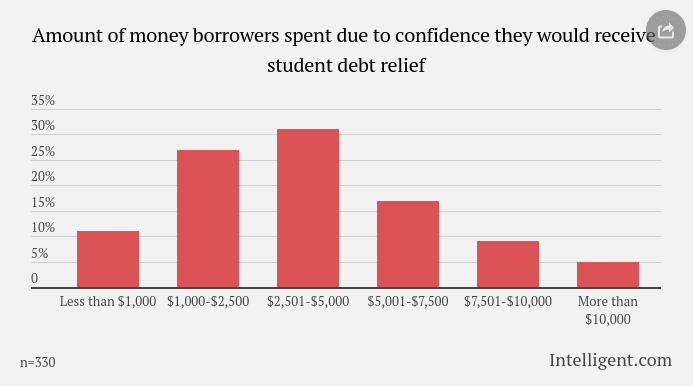

Digging further, the poll revealed intriguing insights into the spending habits of these hopeful borrowers. Approximately 31% squandered between $2,501-5,000, 27% expended between $1,000-2,500, 17% drained between $5,001-$7,500, while $7,501-$10,000 and above $10,000 was spent by 9% and 5% respectively. A mere 11% of respondents contained their spending below $1,000.

Surprisingly, the most popular expenditure was towards retail items, accounting for 44% of the spenders. Paying off other debts came second with 37% of respondents choosing this route. Other popular channels of spending included home and auto payments, childcare costs, and initial installment payments on vehicles and homes. Vacations proved alluring for about 20% of respondents, contrasted by the 8% who directed funds towards alcohol or drugs, and another 7% who succumbed to gambling.

The thwarting of the proposed $10,000 relief now leaves over half the borrowers reeling under financial unpreparedness, with repayments scheduled to resume this October. Precariously, 35% of them feel “very unprepared” and another 23% considering themselves “somewhat unprepared.” Alarmingly, more than a quarter confessed they might “refuse to pay,” a defiant stance that clearly reflects their resentment towards the failure of a seemingly promised relief.

The Supreme Court’s snub to Biden’s loan forgiveness plan came in a decisive 6-3 verdict, clarifying, “The Secretary asserts that the HEROES Act grants him the authority to cancel $430 billion of student loan principal. It does not.” According to a White House fact sheet, 26 million Americans had either applied or were automatically eligible for the debt relief that exclusively targeted those earning less than $125,000 and couples below the $250,000 bracket. The plan, estimated at a staggering $400 billion by the Congressional Budget Office, also promised to forgive up to $20,000 for those receiving Pell Grants.

In conclusion, the false hope of impending student loan forgiveness led a significant number of borrowers to overspend, only to now find their financial stability imperiled with the abrupt dismissal of the plan. This stark revelation underpins the urgent need for sustained and tangible solutions, and not mere political promises, to address the pressing issue of student debt that currently afflicts millions of Americans, disrupting their fiscal plans and overshadowing their futures. The harsh reality is that the promise of relief was indeed an illusion.